Tax Return Fees:

In order to begin preparing your return, payment of the greater of $100 or 50% of the estimated fee may be made by cash or check with the balance due at the time the tax return is picked up or mailed and before we file your return.

Our fees are based on a total of the particular forms required to complete your return using special care and attention to detail. A base rate is assigned to each form and in certain circumstances the time it takes to complete your return will be a consideration that requires an adjustment. Clients who have their tax information and documents organized ahead of time, submit complete information, and are quick to respond with any questions we have will be charged lower fees as we can complete the work more efficiently.

After a free short consultation with you to gather your tax information, we will give you a rough estimate of our fees so that you have an idea of what to expect to pay before we complete your return. This fee estimate may change a little since it is possible that we discover additional information after we begin the work.

We do not, however, give free quotes on the actual amount of your refund as this would require us to complete your return for free. By choosing us to prepare your tax returns you are choosing attention to detail and the maximum legal refund or minimum legal tax liability.

A tax return preparation business quoting the highest refund or that they will beat their competition does not necessarily mean it is legal according to the tax code! However, when the IRS detects the false return, the taxpayer must pay the additional taxes and interest and may be subject to penalties.

IRS Urges Taxpayers to Choose a Tax Preparer Wisely for the Filing Season Ahead

– Our rates are subject to change at any time –

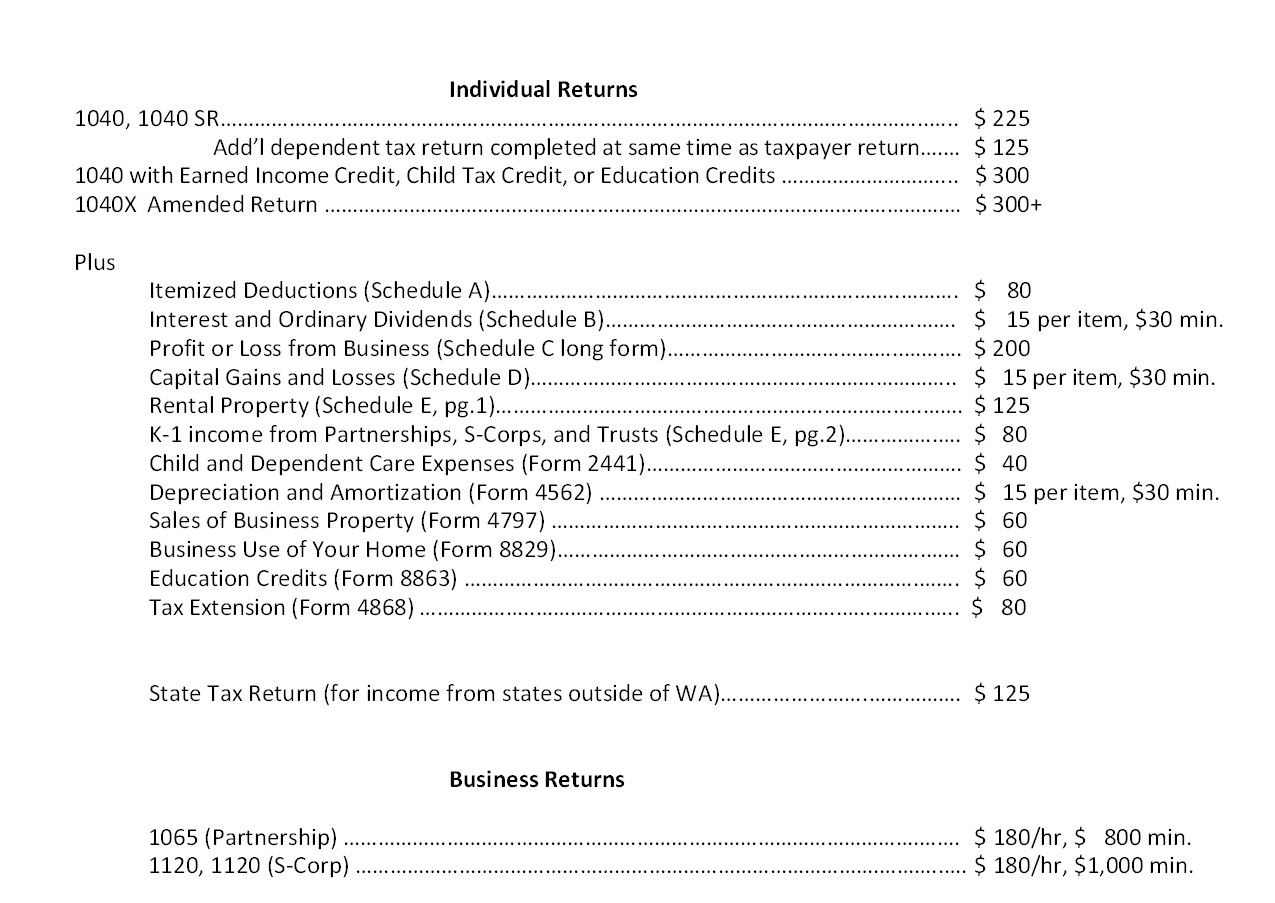

The following are some examples of our typical rates for individual and business returns including a few of the major additional schedules, forms, or returns that might be needed:

Your actual return may include additional forms and schedules not listed above depending on your tax information. Call today for a consultation to discuss how we can help you with your return and for an estimate of our fees. We offer up to 30 minutes consultation included with the preparation of your return. Additional time will be billed at our standard hourly rate of $180.

Small Business Payroll Services:

Full Service Payroll (WA state) – Annual fee per employee $640-760 (based on # of employees)

Full service payroll includes:

- Semi-monthly (2 paychecks per month/24 per year) paycheck timecard hour calculations

- Tax withholding calculations for all required payroll taxes

- WA paid sick leave accruals tracking

- Custom payroll additions and deductions – ex. bonuses, employee advances, etc…

- Check printing

- Physical delivery (local area) or postal delivery

- W-2 printing and mailing to employees.

For this service your business only needs to provide completed time card information and we do everything else!

Full Service Payroll Tax Report Filing (WA state)* – Annual fee $1230

Full service payroll tax report filing includes:

- Form 941 quarterly tax reports

- Form 940 annual tax report

- Labor & Industries quarterly tax reports

- Employment Security quarterly tax reports

- WA Paid Family & Medical Leave quarterly tax reports

- WA Cares quarterly tax reports

- Reports are either filed electronically or mailed certified mail

*If we do your payroll, this tax reporting service is also required.

Consulting Fees:

Our fees for general business and accounting consulting services are based on our standard hourly rate of $180. Before we begin a consulting engagement we will discuss the estimated number of hours it will take to complete in order to determine an appropriate quote. Work will be billed promptly so that you are aware of the charges as they accrue. Payment is due upon completion of our services. In some circumstances payment arrangements or credit will be available.

The billing rate for experienced CPAs is typically $150 – 300 per hour. Some highly specialized CPAs charge up to $500 per hour. We hope to earn your business by providing great service and reasonable rates. You can also be assured that David is personally completing your work with care and attention to detail.